The Enforce and Protect Act (EAPA) is a section of the Trade Facilitation and Trade Enforcement Act (TFTEA) of 2015 that sets established rules, regulations, and procedures regarding antidumping (AD) and countervailing (CV) allegations. Any 'interested party' can submit an electronic allegation (e-allegation) and report the evasion violations via EAPA. However specific documentation requirements must be met, including:

- Meeting the definition of an interested party;

- A statutory description of covered merchandise and AD/CVD order;

- Demonstrate that AD/CVD evasion has occurred.

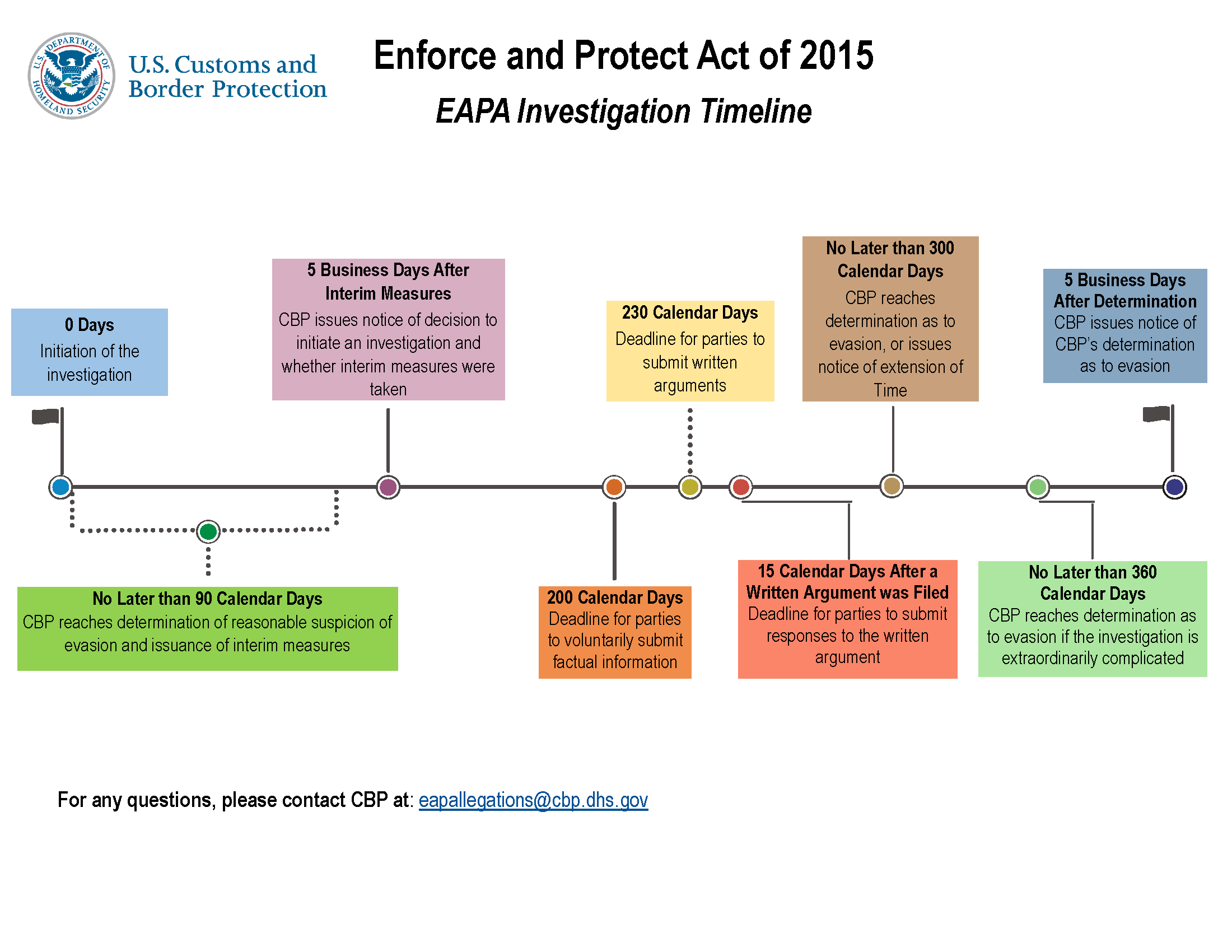

U.S. Customs and Border Protection (CBP) is responsible for the receipt, vetting, enforcement and final disposition of an investigation into AD/CV. The process can take up to one year for a determination depending on the complexity of the evasion allegations. The investigation timeline indicates the timeframes in which CBP must adhere to a timely resolution. Of course, it is possible for some of these determinations to be made sooner than the timeline show below.

Under the EAPA rules, CBP has been mandated to investigate and prosecute allegations of cases where companies have illegally circumvented the payment of antidumping and/or countervailing (ADD/CVD) duties. Several cases have been brought up for investigation, but the first determination was only made in August.

Under the EAPA rules, CBP has been mandated to investigate and prosecute allegations of cases where companies have illegally circumvented the payment of antidumping and/or countervailing (ADD/CVD) duties. Several cases have been brought up for investigation, but the first determination was only made in August.

First final determination under new EAPA rules

August 22, 2017, brought the first final determination under the new law where CBP found “substantial evidence” that a company, Eastern Trading NY, evaded payment of antidumping duties under order A-570-918. The investigation concluded that the wire hangers were intentionally transshipped from China through Thailand (EAPA Case 15135/7175) declaring a fraudulent country of origin, thereby avoiding the payment of antidumping duties.

What does this mean going forward?

Once an affirmative case determination has been made, the EAPA implementation policy mandates the CBP Trade Remedy and Law Enforcement Directorate (TRLED) to implement “rule sets” to comb through trade data and identify other parties that may be involved in ADD/CVD evasion. Companies should remain particularly alert for inquiries from CBP, such as a request for copies of entries or CBP Form 28 Requests for Information, as they may be an indication that Customs is reviewing their entries for possible ADD/CVD evasion.

With the advent of “big data” under ACE and the maturation of CBP’s new Centers of Excellence & Expertise (known as CEEs or Centers), the ease in which Customs can engage in “copycat” investigations is accelerating. Importers should be aware of active EAPA investigations and more generally the scopes of active ADD/CVD cases in countries from which they import goods.

EAPA implementation means stricter trade enforcement for importers; knowing key information, as in the case of the wire hangers, rules concerning country of origin qualifications, and which materials and goods fall under ADD/CVD will guide you in ensuring compliant trade practices.