You don't have to run for cover, we've got your back. Let us help you understand what an HTS is and what it means for your imports. What is the United States Harmonized Tariff Schedule (USHTS, or HTS, and sometimes referred to as HS or Harmonized System)?

All goods imported require classifying. By classification, we mean that every product is assigned a number - that number has different sections separated by a period. Each section means something different.

The Beginning of the HTS

To start with, the Harmonized System was developed by the World Customs Organization (WCO) in 1988 so countries could measure various statistics relating to global trade. For example, a country might want to know the quantity of a certain item imported or exported. Given this information, they can assess duties, administer quotas, and ensure regulatory compliance and consumer safety.

Be aware: improper classification could result in stiff penalties and require you to tender unexpected duties.

Breaking down an HTS number

To start with, you'll need to understand the HS hierarchy. There are 22 sections to the USHTS, and 99 chapters, which are then organized from least to most complicated.

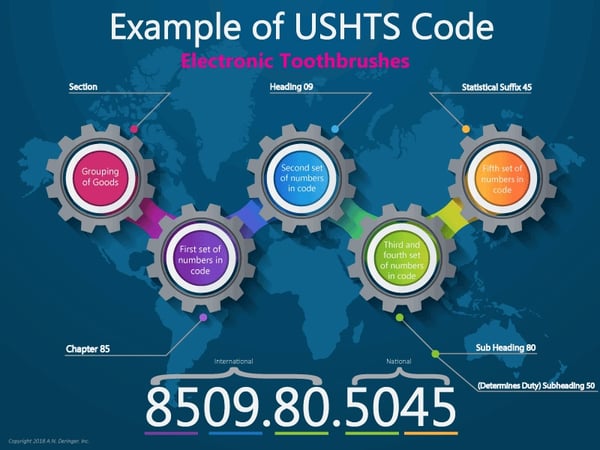

There are five parts to the HTS code:

- Sections - the broadest description of goods throughout the schedule;

- i.e. automobiles, plastics, metal, etc.

- Chapters - first two digits is the narrowing down of a product section;

- i.e. electric toothbrushes are under Chapter 85: Electrical machinery and equipment and parts thereof...

- Headings - second two digits further narrows the type of product;

- i.e. electric toothbrushes are categorized under heading 8509: Electromechanical domestic appliances...

- Subheadings - third set of digits narrows futher to 8509.80 under other appliances;

- the fourth set of digits - another subheading, 8509.80.45 provides the final categorization and is where information about duties will be identified by CBP.

- Suffixes - fifth set of digits used for statistical purposes;

- i.e. tracking how many items with this number were imported.

In the case of the electronic toothbrush, if it comes from a 2018 Normal Trade Relations (NTR) country the duty rate is 4.2%. If the item is non-NTR (Cuba & North Korea), the tariff is 40%.

General rules of interpretation identify how to use and understand the tariff schedule. The WCO applied the rules stating that the first six digits of the code are universal; however, the HTSUS classification is 10 digits, and this can vary from country to country. Almost 100 percent of the time, the first six digits are the same around the globe.

The US International Trade Commission (USITC) and the Office of Tariff Affairs and Trade Agreements publish the HTSUS annually, and update it throughout the year. Knowing this information is important for importers.

What's the big deal with HTS codes?

An HTS number not only identifies your product internationally to Customs agents around the world, but it also indicates the amount of duties applicable to the product. The risks associated with misclassification include:

- Financial penalties

- Legal penalties

- Seizure of goods

Getting your HS correct is imperative if you want to avoid penalties and losses. Speak with your supplier and ask for the code they have assigned to your product. This is usually the best place to start, but then call your Customs broker and provide them a detailed description of your goods and the classification number. They will review the information you provide and advise the suggested classification you should use.

Once you've secured that information, you will then be able to find out how much, if any, duties you will need to pay when your goods enter the US.

Do I really need an HS?

In most cases, yes, you should have a harmonized tariff code for your product because this will ensure that when your goods arrive at Customs for clearance they will levy the appropriate import duties.

Customs Automated Commercial Environment (ACE), the system in which entries are submitted to Customs via brokers and importers, uses the HTS numbers to flag Partnering Government Agencies (PGAs) requirements as well. The flag ensures that CBP can enforce PGA governing regulations on imports.

If you do not have it, and cannot get it, then you run the risk of Customs applying the wrong code at the time of import because they will base the classification on the description on the commercial invoice. Ultimately, this could cost you. If this is the route you must go, then we recommend that you be sure your description is detailed and accurate.

Changes to the USHTS may mean classification changes

Since the USHTS is updated annually, and adjusted throughout the year, a regular review of your classification will make sure that you aren't hit with unexpected duties from a change in tariffs.

If you find a significant increase in duty rates, depending upon your product, you might consider tariff engineering. Some manufacturers have been able to adjust their products or materials to realize bottom line savings.

We also know that goods coming from different countries will have different duties applied; therefore, the same product you once got in China for one rate, might be considerably higher today. Sourcing goods from another country might mean a lesser rate, so you could search for a new supplier to achieve lower costs.

What's in it for me?

Now you know how to breakdown the HS code, and why it is essential to have the correct number before your goods reach a port of entry. Proper classifications inform you of your duty rate and will help you identify potential cost savings. Finally, you certainly want to avoid financial and legal penalties as well as seizure of your goods.

Click to Receive Downloadable Diagram