In the past, goods originating in the United States which were exported and then returned have been allowed to enter the U.S. without payment of duties under certain circumstances. Under the Trade Facilitation and Enforcement Act of 2015 (TFTEA) and the new US-Mexico-Canada Agreement (USMCA), there have been changes to the regulatory and documentary requirements to take advantage of these benefits. The burden of proof remains on the importer, and as such, the proof is in the proverbial pudding.

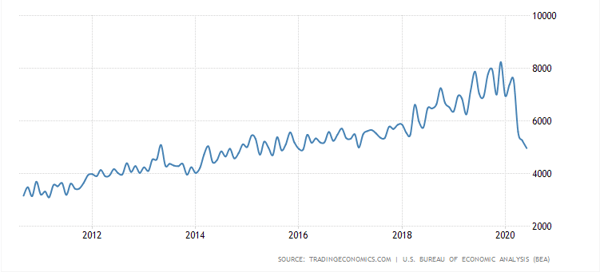

9801 Claims Over Time

According to Trading Economics, citing U.S. Bureau of Industry Analysis statistics, U.S. goods returned and re-imported has been on the rise over the last ten years until recent months.

The proverbial pudding has changed over time. What’s interesting is that claiming U.S. origin goods returned under HTSUS 9801 is different under USMCA than NAFTA. With NAFTA, importers of U.S. goods used 9801 classification in lieu of claiming NAFTA because NAFTA required the goods to be of Canadian or Mexican origin. Conversely, General Note 11 of the USMCA uses a special indicator and specifically allows for goods that originate in the U.S., Canada, or Mexico. Previously, this omission caused some importers to maintain two documentation streams—one for NAFTA and one for 9801 claims. However, TFTEA expands the definition of 9801.00.10 to “all products exported from and returned to the United States regardless of country of origin.”

The Requirements

Entry of U.S. origin goods returning to the U.S. under HTSUS 9801.00.10

The 9801.00.10 HTSUS provision stipulates that the goods may not have been advanced nor the condition improved while the goods were outside the country. In other words, U.S. oak can’t be brought to China and returned to the U.S. as an oak dining room table under U.S. origin goods returned.

To receive the benefit of this provision, the importer must provide documentation to satisfy the tariff provision and conform to 19 CFR 10.1, including:

- Foreign Shipper Declaration: This form, to be completed by a foreign shipper, certifies that the goods were exported from the U.S. and are being returned without being advanced in value or condition while outside the U.S.

- Declaration by Owner, Importer, or Consignee: Similarly, this document is a declaration by the owner, importer, or consignee stating where the goods were manufactured.

- Manufacturer’s Affidavit: Used when the name/address of the U.S. manufacturer is not clearly indicated.

Any drawback previously claimed is required to be repaid upon importation, and there is no time limit for when U.S. goods must be returned.

Here’s an example: ABC Widget Co. exported a $40,000 device to Down Under Gadgets, Inc. located in Australia. The device was fabricated in the U.S. of some imported parts. ABC Widget applies for drawback and receives a partial refund of duties paid on the imported parts used to manufacture the device. Five years later, Down Under decides to return the gadget. ABC Widget Co. completes the Declaration by Owner, Importer, or Consignee form and the other accompanying Customs paperwork, Down Under Gadgets completes the Foreign Shipper Declaration, and the device is re-imported as U.S. origin goods returned. ABC Widget repays the duty drawback refund previously received on the imported parts.

Underlying Customs Guidance:

Articles Conditionally Free, Subject to a Reduced Rate, Etc. (U.S. Goods – 19 CFR 10)

Entry of previously duty paid foreign goods exported and returned to the United States within 3 years

The re-entry of foreign-made goods, for which the duty was already paid when first imported, must be returned to the U.S. within three years. To receive the benefit of this provision, the importer must provide documentation to satisfy the tariff provision and conform to CSMS Message 17-000046:

- Foreign Shippers Declaration

- Proof of Exportation, which may be in the form of ONE of the following:

- Foreign Customs Entry Summary (Ex: Cdn B3 Entry) -OR-

- U.S. Export Invoice or Bill of Lading/Airway Bill -OR-

- Electronic Export Information (EEI) or the Automated Export System (AES) filing exemption. (Electronic System to file exports out of the U.S.)

Note: Goods must be returned to the United States within three years of export from the United States.

Example: ABC Widget Co. imports and pays duty on a $40,000 device from Vietnam-based Hanoi Manufacturing, which they subsequently export to their customer Down Under Gadgets, Inc. in Australia. Four years later, Down Under Gadgets decides to return the device. ABC Widget cannot re-import the gadget under the U.S. and Foreign Goods Returned HTS number because it falls outside the three-year window.

Underlying Customs Guidance:

CBP Cargo System Messaging Service #17-000046 (Foreign Goods)

Entry of U.S. origin goods returning to the United States with the benefit of duty free status under the USMCA agreement

The documents must be in hand to support the claim. A significant regulatory change occurred with the implementation of the USMCA agreement on July 1, 2020. Unlike its predecessor (NAFTA), the USMCA allows importers to claim duty free status on U.S. origin goods under the terms and conditions of the agreement, just as it does for goods of Canada and Mexico. The goods must be considered as originating under the terms of the USMCA, and the importer must have the appropriate documentation in order to support the duty free claim. While there is no longer a documentary requirement to have a specific free trade certificate (e.g., CBPF form 434), the importer is responsible for making a certification containing the required data elements under the terms of the USMCA agreement. This certification must predate the time at which the claim for duty free status is made.

Underlying Customs Guidance:

Unites States-Canada-Mexico Agreement (USMCA) Implementing Instructions (U.S. Goods)

Application of duty free status for goods returning to the United States may be made in accordance with the above avenues for special trade status. If an importer does not possess the required supporting documents, the goods should be treated as fully dutiable for entry purposes. In the event that the appropriate documentary support becomes available at a later time, it may be possible to file a post entry refund claim to recover duties paid.

For claims made at the time of entry, it is the importer’s responsibility to provide the documents to support the claim.

Documents supporting the claim should be in the possession of the filing broker in fulfillment of recordkeeping requirements under 19 CFR § 163. Failure to maintain the appropriate records or provide supporting documentation to U.S. Customs and Border Protection (CBP) upon request may result in the assessment of duties and/or further enforcement actions.

So, the proverbial pudding—the proof—is found in the documents.