The rules and regulations regarding

There are many important questions to ask yourself while dealing with

As additional duties, up to 25%, are being assessed on goods from China, the question of possibly using First Sale keeps coming up as a way to mitigate duty obligations. The First Sale rule allows importers to use the price paid in an “earlier sale” as the basis for the Customs value.

While it is true,

What is First Sale for Export?

A Few of the Many Questions to Ask Yourself:

- During a multi-tiered transaction, at what point is it clear that the merchandise is destined for import into the U.S.?

- What evidence is needed to establish that merchandise is clearly destined for import to the United States in a multi-tiered transaction?

- When is a sale considered to have been conducted at “arm's length”?

Determining when merchandise is clearly destined for export to the United States, in a multi-tiered transaction, can only be made on a case-by-case basis. CBP will consider that merchandise is destined to be a US import once there is evidence which establishes that from the time the middleman purchased or contracted to buy, the imported merchandise the only possible destination was the United States.

- It must be evident throughout the entire transaction that the merchandise is clearly destined for exportation to the United States.

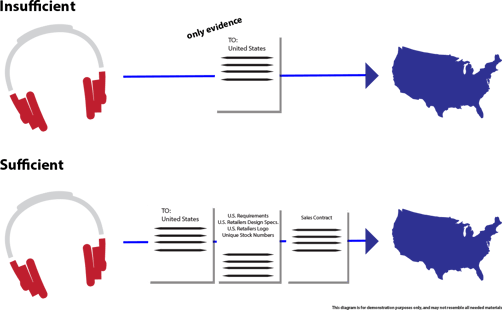

Example: A bill of lading stating that boxes of imported merchandise (i.e., headphones) were addressed to the United States when delivered to the carrier is, by itself, not enough evidence to substantiate that the headphones were clearly destined strictly for the United States. There must be other evidence throughout the paperwork trail—preferably starting with the manufacturer and carrying through to the intermediary and the U.S. retailer/importer. For instance, the documentation should clearly state that the headphones:

- Conformed to U.S. requirements and the U.S. retailer's design specifications (e.g., colors, materials, models);

- had the U.S. retailer's labels, logos, stock numbers, and barcodes;

- also, were shipped directly from the country of the manufacturer to the United States (eliminating the possibility of diversion of the merchandise to another country).

All of this being proven at the time the middleman purchased or contracted to buy the headphones from the foreign manufacturer.

The next question which must be asked when assessing whether merchandise is clearly destined for exportation to the United States in a multi-tiered transaction is: What additional evidence is needed to establish exportation to the United States?

Proof of Exportation

The entire structure of the multi-tiered transaction must have a paper trail, proving validity for the transaction. This includes everything from invoices, sales contracts, purchase orders, proof of payment, shipping contracts, or other documentation for each individual transaction involved.

There are other evidence avenues to establish proof of exportation to only the United States, including manufacture, design, and other unique specs, or characteristics of the merchandise made in conformity with the U.S. buyer's or importer’s standards, logos, stock numbers, barcodes

All this evidence must show that the only possible destination for the imported merchandise was the United States at the time the middleman purchased or contracted to buy the merchandise from the foreign manufacturer.

The takeaway: Be proactive in documenting internal controls, ensuring there is sufficient documentation to back-up First Sale valuation claims.

In addition to the above, importers should be able to describe and document the roles of all the parties involved in the multi-tiered transaction, including the relationship between the intermediary and the supplier.

When is a sale considered to have been conducted at “arm's length”?

While First Rule has been approved for related parties in some instances, CBP will demand evidence that the price is a bona-

This can be a little tricky, however, if parties are related to one another. In this case, a sale would be considered to be at "arms-length" only if an examination of the circumstances of the sale indicates that the relationship between the buyer and seller did not influence the price paid or payable.

There are many other questions which should be considered in addition to the above. First Sale and multi-tiered transactions are